Company Restructuring for PT PMA in Bali

Starting a PT PMA in Bali is a big achievement for many foreign investors, especially those who have decided to

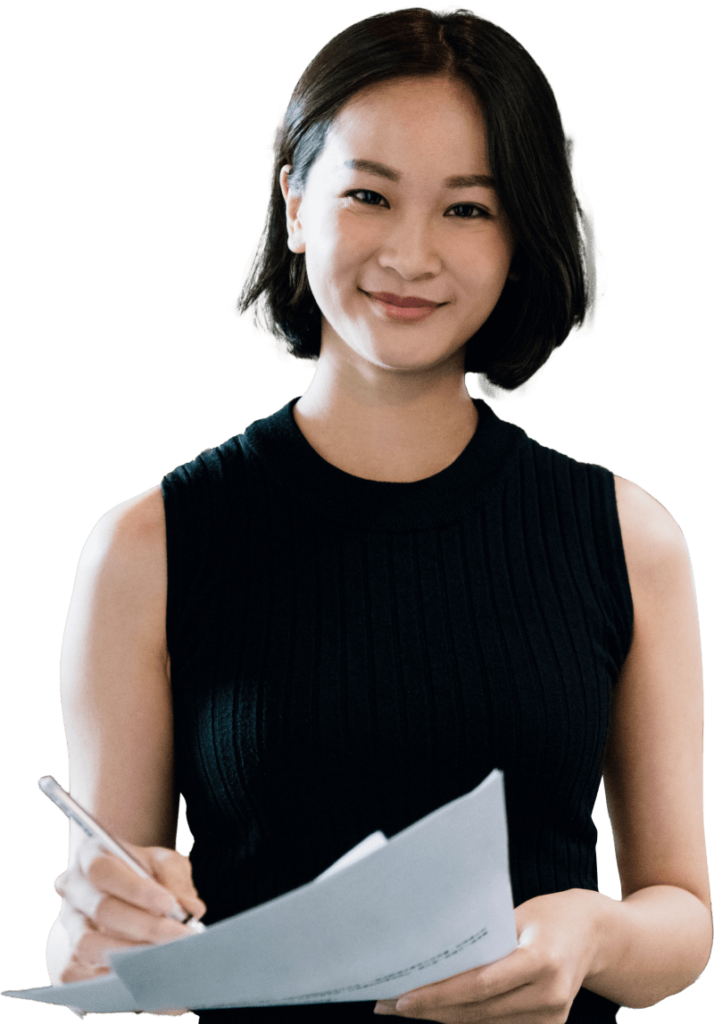

We assist expats in setting up a PT PMA Company in Bali and provide affordable legal and accounting services to support foreign-owned businesses in managing the complexities of Indonesian business operations.

Everything you need, from PMA registration to monthly taxation & accounting, in one package.

Starting from

Monthly Tax Accountancy Fee: IDR 2.500.000 | The first month is FREE as a bonus.

* Extra bonuses are subject to conditions.

Establish a PMA (Penanaman Modal Asing) to comply with Indonesian regulations and secure your investment.

Starting from

Helping foreign-owned businesses handle their tax liabilities and optimize financial management.

Starting from

“

I couldn’t operate my business legally due to an incorrect business classification code.

“

I can’t open a business bank account because I don’t have a business license, and I don’t have any idea how to do it.

“

I tried to report my company investment but was told my villa couldn’t count as company capital.

“

Why is nobody telling me that an investment report is important? Now my business license is temporarily suspended.

“

I couldn’t operate my business legally due to an incorrect business classification code.

“

I tried to report my company investment but was told my villa couldn’t count as company capital.

“

I can’t open a business bank account because I don’t have a business license, and I don’t have any idea how to do it.

“

Why is nobody telling me that an investment report is important? Now my business license is temporarily suspended.

Our consultants ensure clear and effective support, catering to your needs with fluency in three languages.

Our consultants ensure clear and effective support, catering to your needs with fluency in three languages.

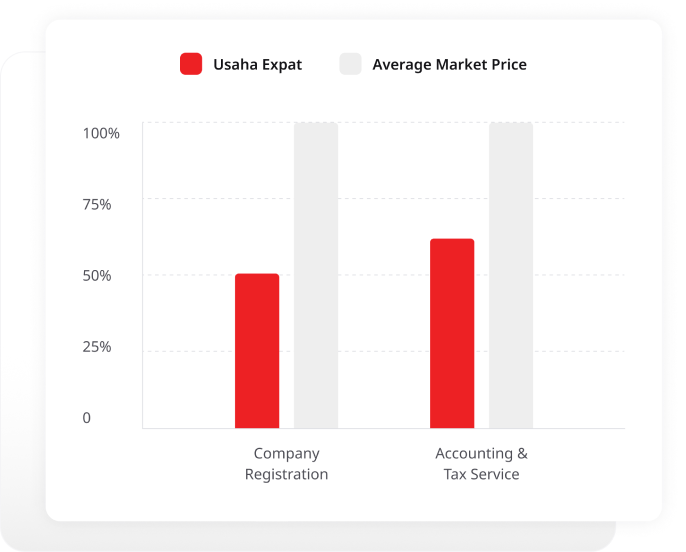

Save up to 50% of your budget to set up your PMA company through a process without surprises. Keep your taxation updated and your accounting healthy.

We maintain clear and open processes, guaranteeing every detail is thoroughly documented.

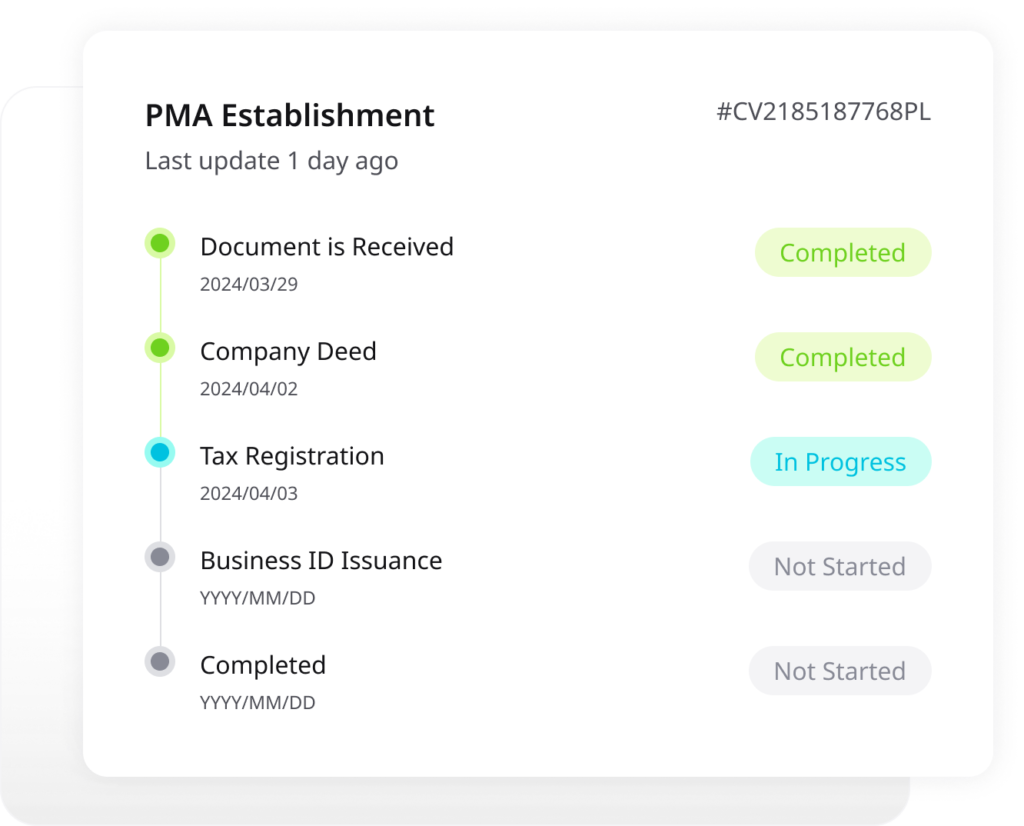

We keep you updated every step of the way, maintaining smooth progress and peace of mind throughout the process.

Affordability doesn’t mean sacrificing quality.

We provide comprehensive services specializing in company registration (PMA) and tax & accounting support.

We offer affordable rates, transparent procedures, and reliable support to simplify setting up and managing your business in Bali.

We support English-speaking and Spanish-speaking consultants who assist foreign entrepreneurs with language barriers in Bali.

Absolutely! We provide guidance and support to help you establish a business bank account for your company’s needs.

Our pricing is competitive and transparent. We offer value-for-money packages to meet your business needs without exceeding your budget.

In addition to company registration and tax services, we provide a range of legal assistance, including contract drafting, contract review, company restructuring, property due diligence, and immigration matters to support your needs in Bali.

A PMA (Penanaman Modal Asing) is a foreign investment company in Indonesia. It’s required for foreign individuals or entities to own and operate businesses in the country.

To establish a PMA, foreign investors must fulfil specific criteria, including business classification (KBLI), capital requirements, and other legal procedures.

The Indonesian government facilitates a new company (PT PMA) with an income tax rate of 0.5% as long as the company’s gross income does not exceed IDR 4.8 billion annually. The company will be subject to standard corporate tax rates if the income surpasses this threshold. This benefit is available for the first three years of operation and cannot be reapplied if income exceeds the limit and later falls below it.

This information is in accordance with the current Indonesian Tax Regulation: Peraturan Pemerintah Republik Indonesia Nomor 23 Tahun 2018 & Peraturan Mentri Keuangan Republik Indonesia Nomor 99/PMK.03/2018.

Normally, it takes two weeks working days, although the timeline may vary depending on the specific services required and the local calendar. In Indonesia, particularly Bali, many national holidays may affect the availability of government offices. However, we work efficiently on the setup process and keep you informed every step of the way.

KBLI is the Standard Classification of Indonesian Business Fields, used to identify the nature of business activities for licensing and reporting purposes.

A PMA can cover various business sectors, including but not limited to real estate, hospitality, tourism, retail, wholesale, consulting, and more.

A company address is the official physical location where a business is registered and operates. It serves as the legal address for receiving correspondence, official documents, and notices from authorities.

If you don’t have a company address or own office, you may use a virtual office service or rent a physical office space. A Virtual Office provides a professional business address without needing physical office space, which is ideal for companies establishing a presence in Indonesia.

No, your home address cannot be used as the registered address for your company. When setting up a company, you must provide a separate business address that meets the regulatory requirements of company registration in Bali, Indonesia.

A Business Domicile Letter (Surat Keterangan Domisili Usaha) certifies the location of your company’s legal domicile or business (company) address.

An NIB, or Business Identification Number, is a unique identification number issued to businesses in Indonesia that is required for operating legally.

We offer comprehensive tax accountancy services, including monthly tax reporting, annual tax returns, bookkeeping, payroll services, and tax advisory.

Taxes are typically reported monthly and annually, depending on the type of tax and business activities.

Hiring a professional ensures accurate financial reporting, compliance with tax regulations, timely submissions, and expert advice to optimize tax efficiency. It also allows you to focus on core business activities, reduce administrative burdens, and access specialized expertise without hiring additional staff.

Common tax obligations include income tax (PPh), value-added tax (VAT), withholding tax (PPh Pasal 21), and annual tax reporting.

NPWP is the Indonesian tax identification number for individuals and companies, which is required for tax reporting, transactions, and compliance with tax regulations.

E-FIN is a digital certificate used for electronic tax filing and reporting. It provides a secure method for tax transactions and communications with tax authorities.

Electronic Certification is a digital signature representing the company director or authorized personnel required for electronic tax reporting and withholding tax purposes.

Income tax rates in Indonesia vary depending on income levels and marital status. For specific details, refer to the official Indonesian tax authority website.

Employee tax rates depend on various factors such as income levels, marital status, and other allowances. For accurate rates, please refer to the information from the official Indonesian tax authority.

For various tax obligations, such as income tax, value-added tax (VAT), and withholding tax, the monthly tax reporting deadline typically falls on the 10th day of the following month.

The annual tax reporting deadlines for companies and individuals usually occur in the first quarter of the following year, with specific dates announced by the tax authorities.

We prioritize confidentiality and security by employing strict data protection measures, secure software systems, and adherence to professional ethics.

Simply contact us for a consultation, and we’ll tailor our services to meet your specific business needs and requirements.

The tax fiscal year is a specific 12-month period for calculating and reporting income and taxes. It may or may not align with the calendar year (January 1 to December 31) and is determined based on a business or organization’s accounting needs.

Company restructuring involves changing the legal, operational, or ownership structure of a business. It may be necessary to optimize operations, comply with regulatory changes, or address financial challenges.

Property due diligence involves evaluating the legal, financial, and operational aspects of a property before acquisition. It helps identify risks and legal encumbrances and ensures a sound investment decision.

Contract review involves examining legal contracts to ensure clarity, fairness, and law compliance. Drafting involves creating legally binding agreements tailored to specific business needs.

An Investment Report (LKPM) is a mandatory report for foreign investment companies (PMA). It provides information on the investment realization and business operations, ensuring compliance with investment regulations.

OSS is an integrated licensing platform in Indonesia that facilitates business establishment, licensing, and permits. It streamlines administrative processes for business setup and operations.

Electronic Certification is a digital signature representing the company director or authorized personnel required for electronic tax reporting and withholding tax purposes.

Starting a PT PMA in Bali is a big achievement for many foreign investors, especially those who have decided to

⚠️ Countless foreigners have fallen victim to property scams in Bali. This is a warning to be especially cautious when

While South Bali has long been the centre of tourism and investment, North Bali is now emerging as a promising

How can I help you with your project?

Typically replies in a few minutes.

Prompt response: 9:30 – 17:00 (UTC +8)

Monday to Friday