Company Restructuring for PT PMA in Bali

Starting a PT PMA in Bali is a big achievement for many foreign investors, especially

Example Calculation:

Payment to Architecture: IDR 500,000,000

PP 23 Calculation:

Tax Amount = 2% of IDR 500,000,000

PPh 23 = 0.02 x IDR 500,000,000 = IDR 10,000,000

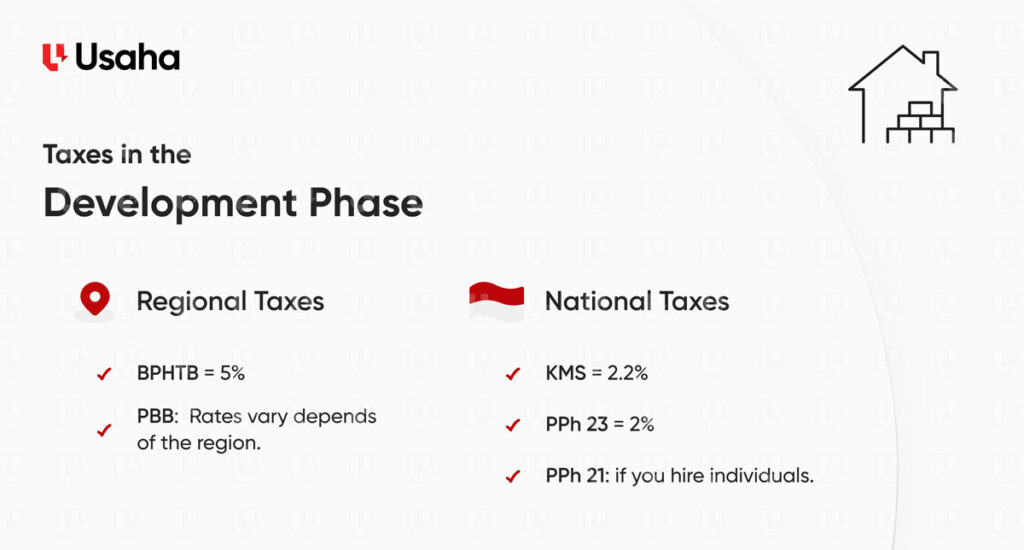

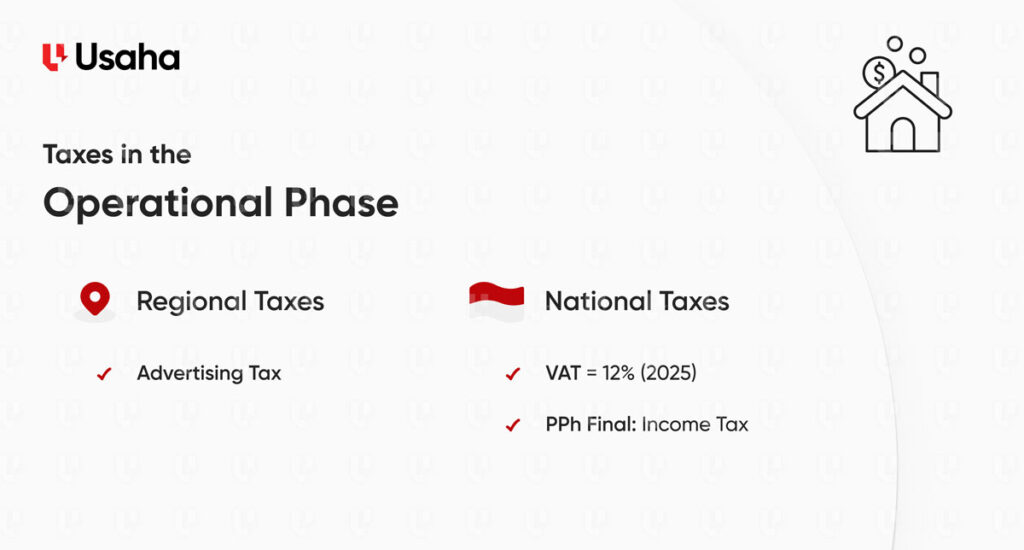

Each phase of your project journey has its own Bali taxes you’ll need to follow for real estate developers. Staying on top of these requirements helps you avoid unnecessary headaches and ensures your project runs smoothly from start to finish.

If you’re overwhelmed by tax regulations or want to ensure you’re covering all your bases, Usaha Expat is here to help. Our team of experts knows the ins and outs of Bali’s tax landscape and can guide you through every step with our Tax Accountancy for PT PMA. We’re here to ensure your business stays on track and thrives in Bali’s vibrant real estate market.

Starting a PT PMA in Bali is a big achievement for many foreign investors, especially

⚠️ Countless foreigners have fallen victim to property scams in Bali. This is a warning

While South Bali has long been the centre of tourism and investment, North Bali is

How can I help you with your project?

Typically replies in a few minutes.

Prompt response: 9:30 – 17:00 (UTC +8)

Monday to Friday