Company Restructuring for PT PMA in Bali

Starting a PT PMA in Bali is a big achievement for many foreign investors, especially

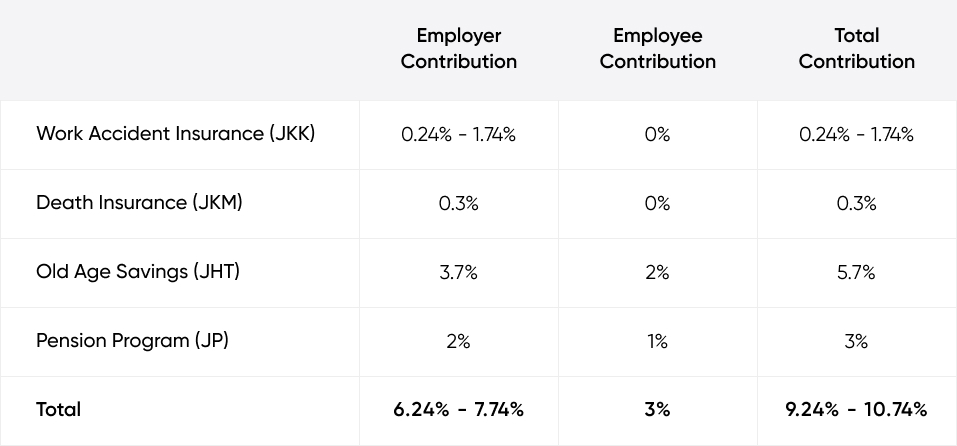

If you’re setting up a PT PMA in Indonesia and are ready to hire local talent, you’ll need to know about a few social security obligations.

Let’s check them out!

BPJS Kesehatan is Indonesia’s national health insurance program, providing employees with medical coverage. Employers must register employees in the BPJS Kesehatan program under Law No. 40 of 2004.

The contributions for BPJS Kesehatan are shared between PT PMA and employees, with the employer responsible for 4% of the employee’s salary and the employee contributing 1%.

How PT PMA pay BPJS Kesehatan:

Employers are responsible for withholding the employee contributions from their salaries and remitting both the employer’s and employee’s shares to BPJS Ketenagakerjaan each month. In addition, remember that payments must be made by the 15th of the following month.

Social security contributions for BPJS Ketenagakerjaan and BPJS Kesehatan also apply to contract employees in Indonesia. Employers must comply with these regulations to ensure that all workers receive essential health and employment protections, regardless of their employment status. However, when hiring freelancers, a PT PMA company do not need to pay social security contributions on their behalf because they are responsible for their own enrollment and contributions.

Enrolling employees in social security is a legal obligation for employers and critical to providing a supportive and secure working environment. To avoid penalties or any legal issues, always ensure accurate calculation of contributions, timely payments, and proper reporting.

Starting a PT PMA in Bali is a big achievement for many foreign investors, especially

⚠️ Countless foreigners have fallen victim to property scams in Bali. This is a warning

While South Bali has long been the centre of tourism and investment, North Bali is

How can I help you with your project?

Typically replies in a few minutes.

Prompt response: 9:30 – 17:00 (UTC +8)

Monday to Friday